India’s top carmakers face rising costs, stricter regulations, and cautious demand, even as boardrooms push for greater accountability.

India’s top carmakers face rising costs, stricter regulations, and cautious demand, even as boardrooms push for greater accountability.“>

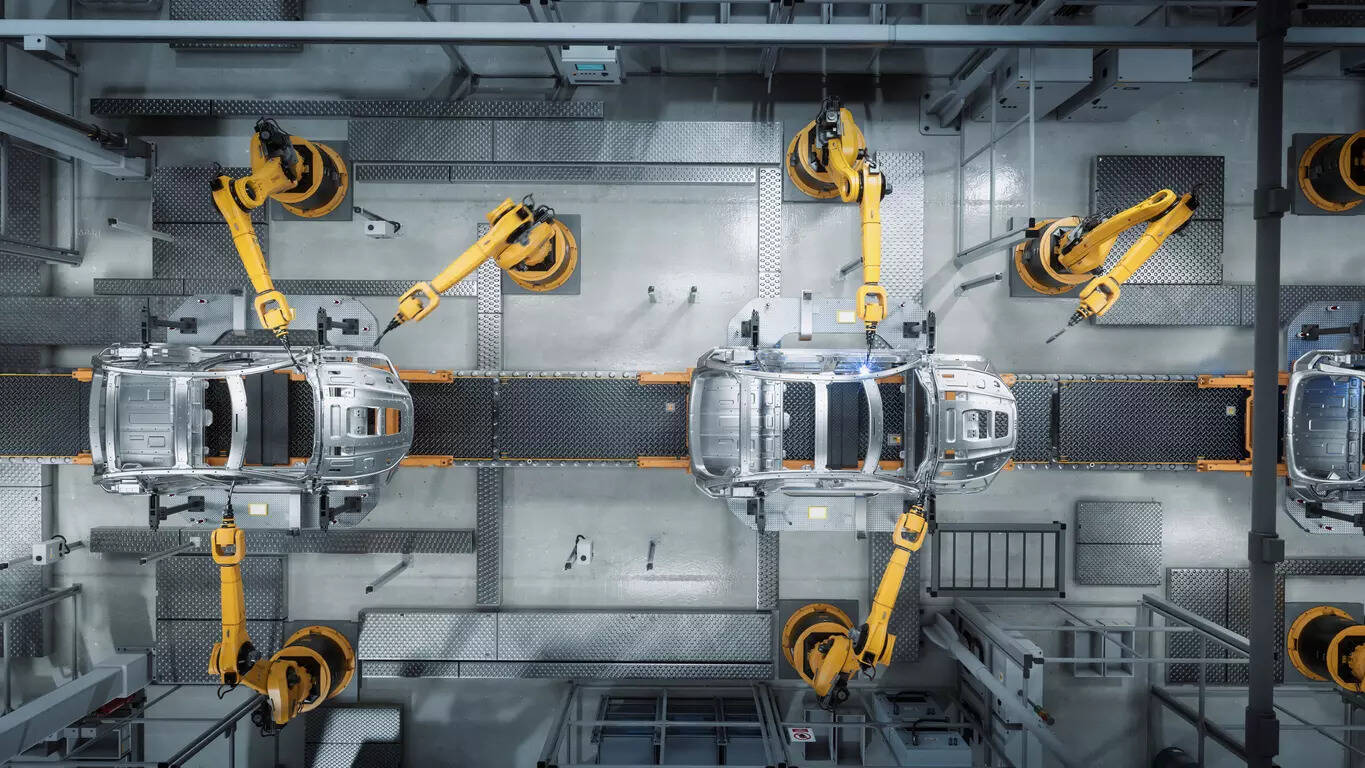

India’s leading car manufacturers are walking a tightrope as they grapple with rising input costs, mounting regulatory pressures and cautious consumer sentiment, all the while being held accountable to increasingly involved boardrooms.To mitigate the impact of rising prices, automakers have turned to aggressive incentive strategies–including exchange bonuses, loyalty programs, and festive offers-to woo hesitant buyers. This push comes at a time when demand in the passenger vehicle segment has softened, particularly in the first two quarters of the financial year, which saw only low single-digit growth.And the numbers tell the story. Though car prices rose by 5 per cent, consumers didn’t feel the full brunt as companies shelled out Rs 8,426 crore in 2024 on incentives, up 45 per cent from 2022, shows data collated by Jato Dynamics.

Carmakers absorbed the impact to soften the blow on scarce consumers.

Margin focus

Manufacturers chose to spend more to maintain perception and keep volumes afloat. From volume brands like Maruti Suzuki, Mahindra, Tata Motors, and Toyota to luxury players, discounts were more precise and targeted than ever before. “The goal is no longer just to sell more cars; it is to sell the right cars, especially higher-margin models,” said an executive from a Mumbai-based automaker.

Though most leading OEMs did not reply to queries, they admit to pain points off the record and are betting on good festive offtake.

Yet, such deep discounting hasn’t come without consequences. “What used to be the domain of sales teams is now a boardroom-level priority,” added the executive, underlining how incentive strategies have evolved from short-term sales boosters to long-term financial levers. CEOs and CFOs are now involved in data-driven planning around these offers.

“We are now pushing for performance-linked offers, not just blanket handouts. Strategies are being fine-tuned to ensure every rupee spent is justified,” said the CFO at a Delhi-based automaker, speaking on the condition of anonymity.”Incentives are smarter, not louder,” said Jato Dynamics president Ravi Bhatia. “Spending is aligning with returns, not just volumes.”The recent GST rate rationalisation has added another dimension to the already volatile market. Automakers are hoping the move will act as a tailwind during the festive season, as the reduced rates make vehicles more affordable.

“This could provide a positive impetus by boosting consumption and bringing customers back to dealerships,” said Naveen Soni, former president of Lexus India. Many OEMs have already started passing on the benefits to customers to stimulate demand during the crucial festival period.

However, there’s a catch. Dealerships are sitting on high inventory levels, and manufacturers had paid higher GST rates on stock produced before the rationalisation. According to the Federation of Automotive Dealers Association, there’s no legal provision to reclaim or offset the excess GST paid, leaving dealers with an estimated burden of over ₹2,500 crore.

“We must toe the line with the manufacturers, as they call the shots. Inventory levels are high, and we are operating in a market riddled with uncertainty,” said a Delhi-based car dealer.

Join the community of 2M+ industry professionals.

Subscribe to Newsletter to get latest insights & analysis in your inbox.

All about ETAuto industry right on your smartphone!

- Download the ETAuto App and get the Realtime updates and Save your favourite articles.